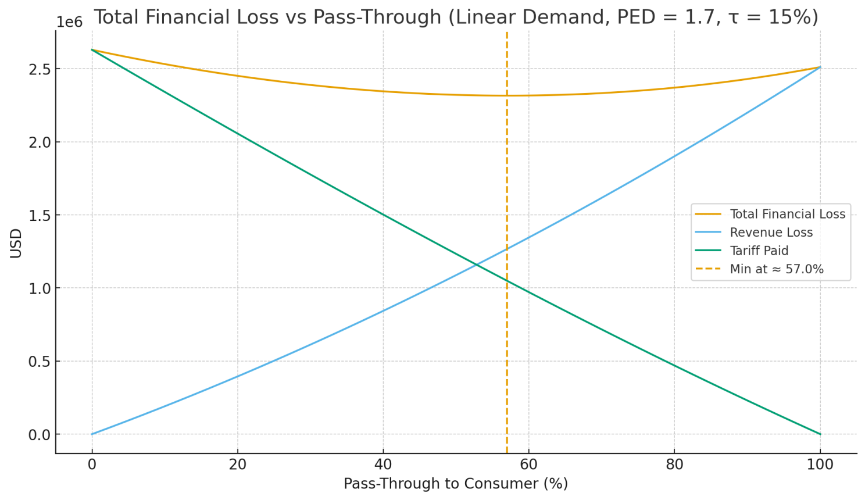

Finding the optimal tariff pass-through means balancing cash costs and revenue loss to minimize total financial impact.

When tariffs raise your costs, you have two levers:

- Pass-through: raise prices so customers pay.

- Absorption: hold prices and let margins take the hit.

The real goal isn’t “pick one.” It’s to minimize total financial loss, which comes from:

- Tariff cash paid if you absorb, plus

- Revenue lost if higher prices reduce volume.

Somewhere between 0% and 100% pass-through, there’s a sweet spot where these two losses are lowest.

Why this matters now

Tariffs have been impacting multiple industries and products. A recent HBS article showed a steady price increase for many retail goods in the US (1). As another example, automakers have been hammered by tariffs, with the industry tallying ~$12B in hits and Toyota alone facing a ~$9.5B impact through its fiscal year, numbers big enough to sway pricing, sourcing, and production footprints (2). The strategic question is no longer “tariff or no tariff,” but “what mix of pass-through vs. absorption minimizes damage while preserving market share and margins?”

A simple, practitioner-ready approach

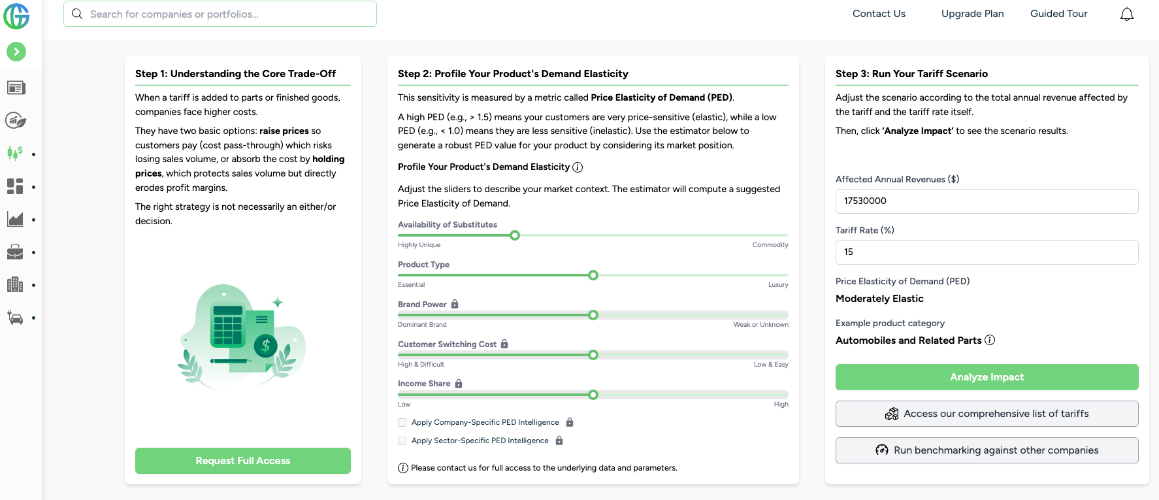

We built a model to find that sweet spot with just three inputs:

- Tariff rate (e.g., 15%)

- Share of sales affected

- Price Elasticity of Demand (PED), how price-sensitive customers are

You can model the affected revenue with a straightforward linear demand response, consistent with how practitioners often work with PED (Price Elasticity of Demand) then plot Total Financial Loss across pass-through from 0→100%. You’ll typically see a U-shaped curve:

- Low pass-through: protects volume, pays more tariff

- High pass-through: pays less tariff, loses more revenue The lowest point is your optimal pass-through.

What the numbers say (automobile manufacturers case)

Using a representative scenario for automobile manufacturers (15% tariff; PED ≈ 1.7), the minimum typically lands inside the range, often around ~55–60% pass-through because:

- Passing too little means paying a lot of tariff in cash.

- Passing too much means losing revenue from elastic demand. A balanced split tends to minimize the combined hit.

(See the WSJ’s coverage for context on how tariffs are shaping automaker pricing and production decisions, including Toyota’s guidance on tariff impacts.)

How the optimum shifts with PED

- Lower PED (less price sensitive) → optimal is closer to 100% pass-through.

- Higher PED (more price sensitive) → optimal moves toward 0% (absorb more). Many portfolios sit in the middle, where ~40–60% pass-through often minimizes loss.

From headlines to playbooks

Recent reporting shows automakers juggling all three levers: price, mix, and footprint, to blunt tariff shocks. The WSJ documents the scale (billions) and the strategic pivots (e.g., accelerating U.S. localization) that complement pricing decisions (2). Price alone rarely solves a tariff shock when demand is elastic and competitors react; optimal pass-through is a starting point, not the full strategy.

Put it to work

- Segment by elasticity (don’t set one policy for all products).

- Pilot and monitor competitors (effective elasticity can change).

- Refresh quarterly (PED and competitive context move).

Try the free interactive tool to run your own scenarios: https://rift.rgsciences.com/tariff-tools/tariff-strategy-explorer

Use it to brief leadership and align on a defensible, data-driven pass-through policy per product or market.

Thanks to my co-authors Ben Gregory for explaining to me how economics theory works and helping create a very useful data product within a very short timeframe and Dr. Barnabas Acs, Ph.D. for extensive discussions on how fundamental data can be useful to mapping real world tariff impacts.

- [1] Retail Prices Were Heading in the Right Direction—Then Tariffs Hit, available at: click here to visit [1] Retail Prices Were Heading in the Right Direction—Then Tariffs Hit pagehttps://www.library.hbs.edu/working-knowledge/why-rising-prices-might-feel-worse-now-tariff-trendlines?utm_source=SilverpopMailing&utm_medium=email&utm_campaign=Daily%20Gazette%2020251007%20(1)

- [2] Auto Industry Takes $12 Billion Hit From Trade War, available at: click here to visit [2] Auto Industry Takes $12 Billion Hit From Trade War pagehttps://www.wsj.com/business/autos/auto-industry-trump-tariff-impact-955ca0bf