Climate Transition Alignment Tool

Curate the full ecosystem, analyze the value chain, and pinpoint companies that deploy or develop climate technologies. Leverage this robust tool for thematic investing, equity research, portfolio construction or analysis. Our proprietary AI tool delivers the most precise mapping of climate solutions to company activities, enabling investors to identify publicly traded firms that are actively driving the transition to a low-carbon economy.

Climate Solutions

We focus on companies offering climate solutions that develop or implement technologies driving the transition to a low-carbon economy. Through RGS’s proprietary AI tool and advanced analytics, we help investors identify these companies and track market trends over time, all accessible via our impact intelligence platform.

90+ Climate Solutions with quantified climate abatement potential

10Ks, quarterly earnings reports, business descriptions, RGS' products & services revenue datafeed

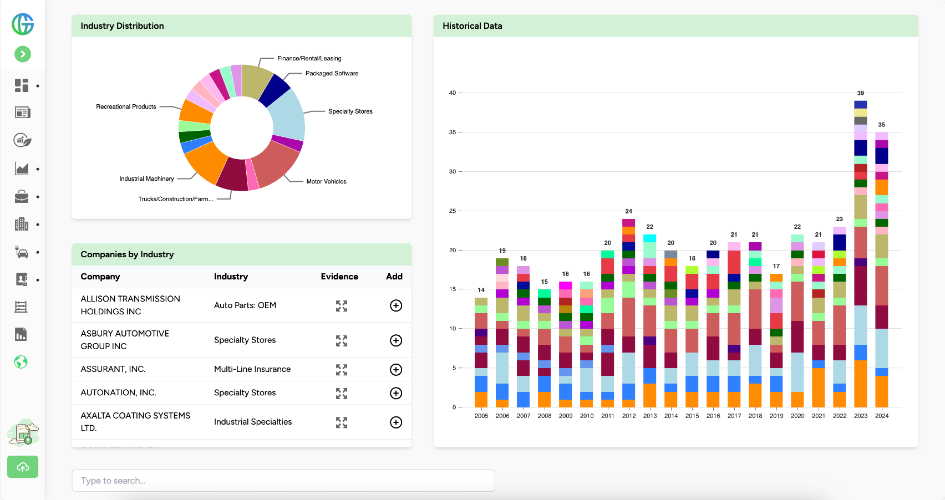

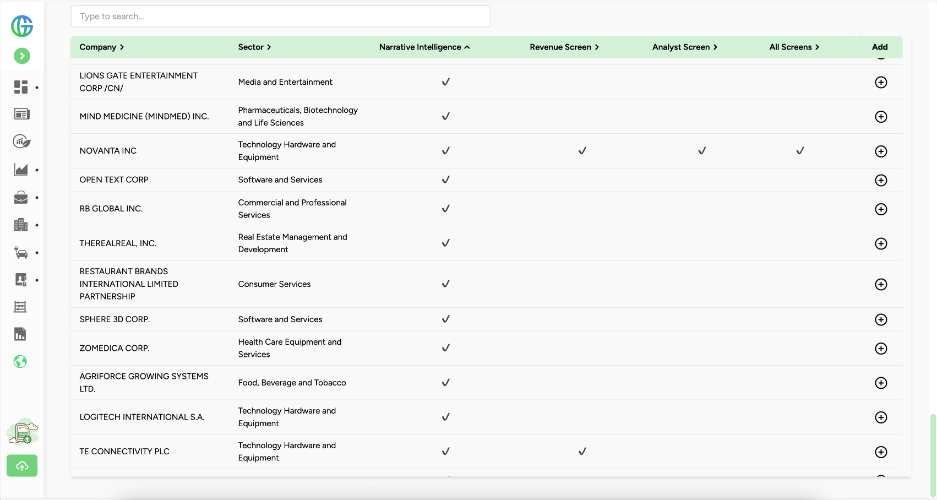

Thematic Portfolios

We provide a pre-populated list of the most common impact investing and climate solutions themes, and apply screens to identify companies whose business operations and activities are aligned with the selected theme, then narrow the universe to companies that are generating revenue from it.

Themes such as Electric Vehicles, Sustainable Aviation Fuel, etc.

Qualitative, quantitative, revenue, analyst screens

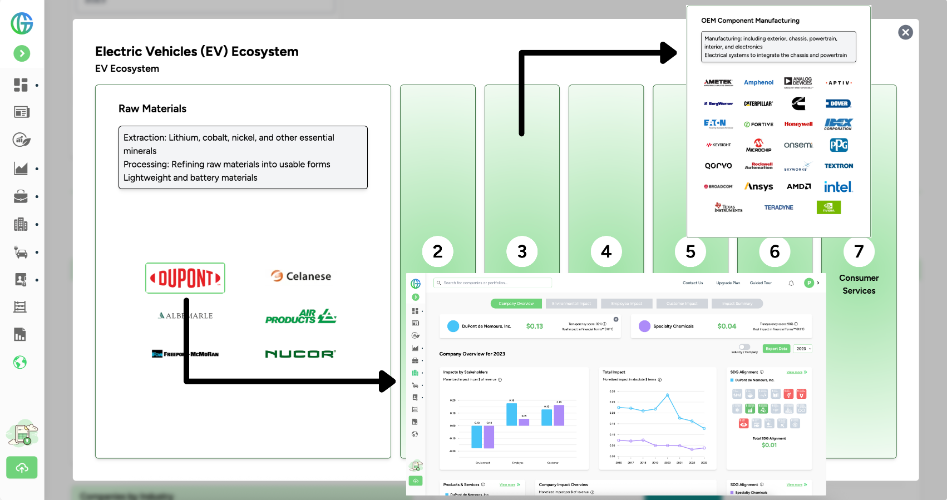

Ecosystem Mapping

We map companies and their climate solutions across the entire ecosystem, helping investors analyze the value chain to identify companies that align directly with each stage.

From Raw Materials to Consumer Services

Key Trends & Players displayed at each stage of the value chain

main use cases

Portfolio construction

Equity research

Thematic investing

90+

Climate solutions with a potential to reduce or sequester GHG emissions

1,000+

Public companies are mapped to climate solutions

Investment Themes

Electric Vehicles, Renewable Energy, Bioplastics, Smart Agriculture, Artificial Intelligence,

...and many more

From Activity to Impact

Go beyond revenue: understand how companies actively enable climate transition

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

The Climate Transition Alignment Tool identifies companies that develop or deploy technologies supporting the transition to a low-carbon economy. It maps corporate activities to climate solutions, enabling investors to assess alignment with climate transition goals.

Climate solutions are identified using RGS' proprietary classification and analytics framework, which combines revenue data, business descriptions, and impact assessments to determine whether a company meaningfully contributes to climate transition technologies.

The tool covers a wide range of climate solutions, including renewable energy, electric vehicles, energy efficiency, sustainable agriculture, and other technologies with measurable potential to reduce or sequester greenhouse gas emissions.

Companies are mapped across the full climate solution ecosystem, from raw materials to end-use applications. This allows users to analyze value chain exposure and identify companies aligned with different stages of the climate transition.

Investors use climate transition alignment data to support thematic investing, portfolio construction, equity research, and risk assessment related to climate transition and decarbonization strategies.

The tool links company revenues and activities to quantified climate impacts, translating business exposure into measurable climate transition outcomes that can be analyzed alongside financial performance.