Public Equity Investors

We enable asset owners and investors to maximize positive impact on the Environment and Society while generating Financial Returns.

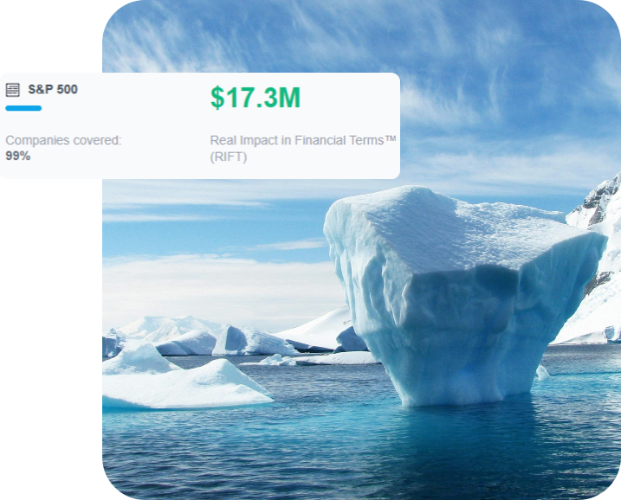

Impact Analytics

Conduct impact reporting, assessment and analysis by using our comprehensive dataset for publicly listed companies, aligned with impact accounting principles.

click here to visit Impact Analytics pageLearn More

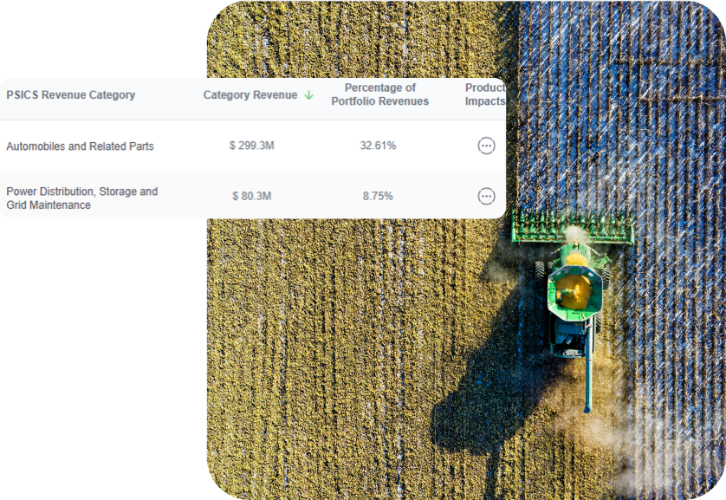

Products and Services Revenue Datafeed

Access precise revenue classifications for thematic investing, index creation, alignment to SDGs, benchmarking and more.

click here to visit Products and Services Revenue Datafeed pageLearn More

UN SDG Impact Alignment

Report the contribution of portfolios or companies to the Sustainable Development Goals (SDGs) in terms of monetized impact.

click here to visit UN SDG Impact Alignment pageLearn More

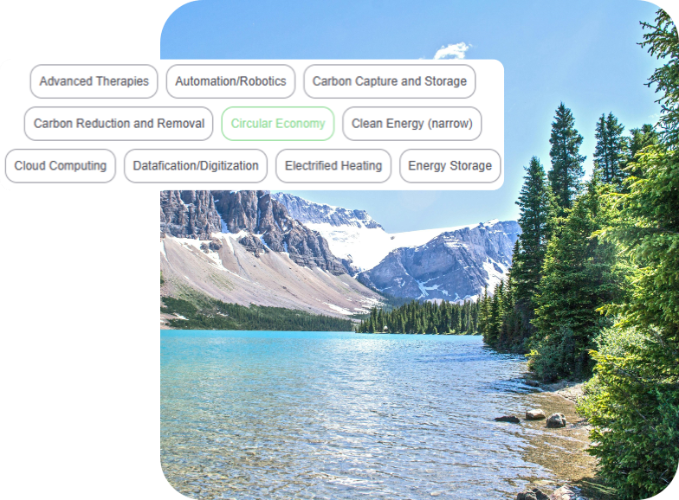

Climate Transition Alignment Tool

Identify companies which develop or deploy climate solutions, facilitating the transition to a low-carbon economy.

click here to visit Climate Transition Alignment Tool pageLearn More

AI Thematic Investing Solutions

Save time finding investments that target ideas, personal values or transformational megatrends. Turn your themes into an investable universe.

click here to visit AI Thematic Investing Solutions pageLearn More

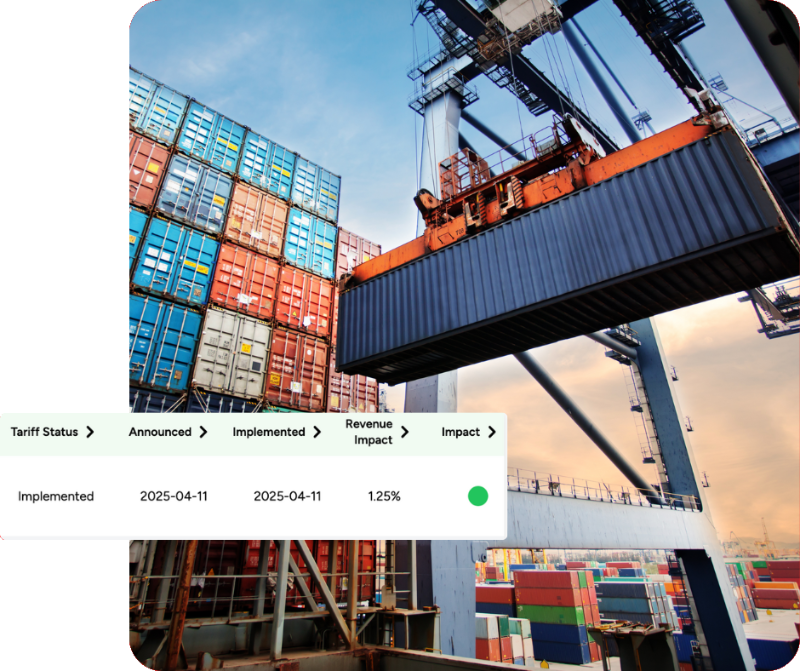

Tariff Impact Analytics

Quantify revenue risks from tariffs in real time and adjust portfolios with forward-looking, automated analytics.

click here to visit Tariff Impact Analytics pageLearn More

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

RGS supports public equity investors by providing data-driven insights into the environmental and social impact of publicly listed companies. The platform helps investors integrate impact analysis into portfolio construction while maintaining a focus on financial performance.

Public equity investors can integrate impact by using monetized impact data, revenue-based exposure analysis, and SDG alignment metrics to assess how companies generate positive or negative outcomes alongside financial returns.

The platform supports portfolio-level impact assessment, company benchmarking, thematic exposure analysis, climate transition alignment, and tariff risk analysis, enabling a holistic view of both impact and risk.

Impact analytics adds an additional layer of insight by quantifying externalities that are often not reflected in financial statements. This helps investors identify long-term risks and value drivers that may affect company performance over time.

Yes, RGS supports ESG and impact reporting by providing transparent, auditable data aligned with impact accounting principles, UN SDGs, and other widely used sustainability frameworks.

RGS solutions are used by portfolio managers, equity analysts, ESG specialists, and risk teams seeking to integrate measurable impact into investment research and decision-making.