Private Equity Investors

We help general partners and their portfolio companies with impact assessment, reporting, and data collection - aligned with impact accounting principles.

Private Markets Impact Benchmarking

Benchmark portfolio company performance against peers and industry-specific baselines using structured impact indicators.

click here to visit Private Markets Impact Benchmarking pageLearn More

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

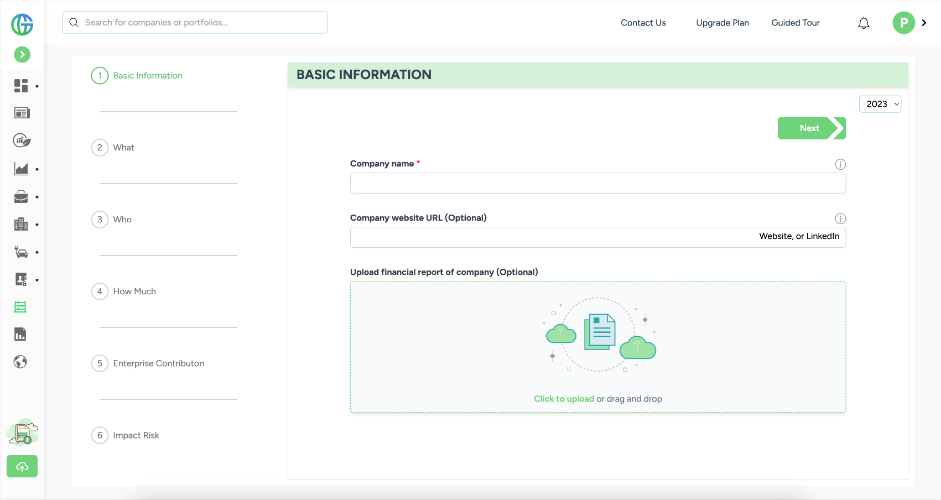

RGS supports private equity investors by providing impact assessment, benchmarking, and reporting solutions tailored to private markets. The platform helps general partners evaluate and improve the impact performance of portfolio companies using structured, data-driven methodologies.

Private markets impact benchmarking compares portfolio companies against peers and industry-specific baselines using standardized impact indicators. This enables private equity firms to identify relative performance, improvement areas, and value creation opportunities.

RGS supports structured data collection through standardized templates and workflows designed for private companies. This ensures consistency, auditability, and alignment with impact accounting principles across diverse portfolio holdings.

Impact data helps private equity investors identify operational risks, efficiency improvements, and growth opportunities. By linking impact performance to business activities, investors can support portfolio companies in driving both financial and impact outcomes.

Yes, RGS enables private equity firms to produce transparent, comparable impact reports for limited partners, aligned with recognized sustainability and impact accounting frameworks.

RGS solutions are used by general partners, investment teams, operating partners, and ESG or sustainability leads involved in portfolio management, reporting, and value creation initiatives.