RGS Impact Leaders Portfolio

The RGS Impact Leaders Portfolio features 275 leading global publicly traded companies that excel in Environmental, Employee, and Customer impact dimensions. As the first-ever index grounded in impact valuation of companies, it provides unparalleled insights into the long-term value creation of impact. Powering this innovation is RGS' proprietary AI tool, patented engine, and science-based methodology, leveraging 60+ outcome-based metrics and the latest social cost models to value companies in alignment with impact accounting principles.

Impact Criteria

To qualify, a company must meet the following criteria:

A company must be a leader - i.e., rank in the top 25 for total monetized impacts (calculated across the Environment, Employment, and Customer impact pillars) within its sector.

Diversity Across Sectors and Regions

To maintain a fair and balanced representation of the various sectors of the economy, the index covers all 11 sectors, recognizing the top 10 companies in each for their impact results across the globe.

All 11 sectors covered

North-America, Europe, Asia / Pacific

Quick Facts

The RGS Impact Leaders Index is:

Market-cap Weighted

Rebalanced annually

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

The RGS Impact Leaders Portfolio is an index of publicly traded companies that demonstrate leading performance across environmental, employee, and customer impact dimensions. It is built using impact valuation methodologies aligned with impact accounting principles.

Companies are selected based on their total monetized impact performance within their sector. To qualify, a company must rank among the top performers in terms of combined environmental, employment, and customer impact.

Unlike traditional ESG indices that rely on scores or disclosures, the Impact Leaders Portfolio is grounded in outcome-based, monetized impact data. This enables a more objective and comparable assessment of real-world corporate impact.

The portfolio evaluates impact across three core dimensions: Environment, Employees, and Customers. Each dimension is measured using science-based models and outcome-driven metrics.

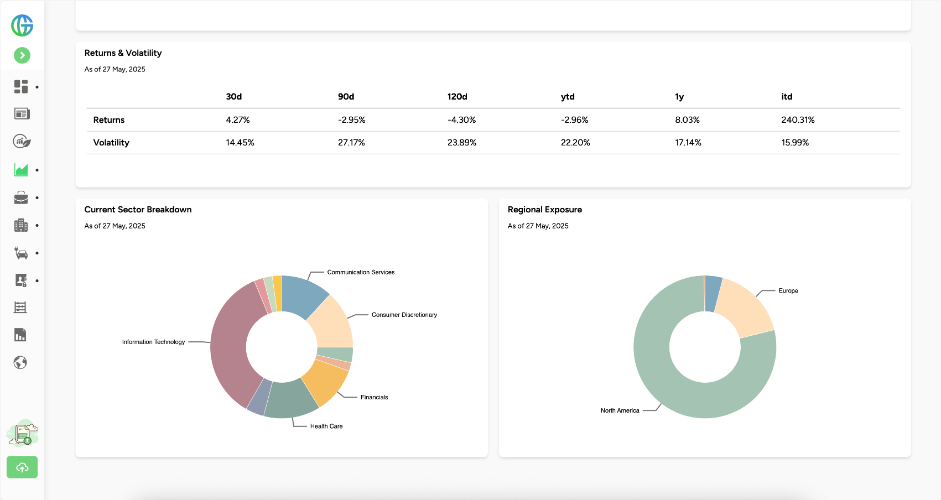

The portfolio is market-cap weighted, rebalanced annually, and designed to ensure representation across all major sectors and regions. This supports diversification while maintaining a consistent impact leadership focus.

The Impact Leaders Portfolio is used by investors, asset managers, and researchers seeking a benchmark or investable universe aligned with measurable, long-term impact performance.