The Price of Ice

The Economics of the Greenland Tariff Escalation

On January 17, 2026, a 16-word post on Truth Social ignited the "Arctic Crisis." The ultimatum was simple: the "Arctic Coalition" (Denmark, Sweden, Finland, et al.) must facilitate the sale of Greenland to the US, or face immediate trade penalties. This briefing deconstructs the conflict. It moves from the geopolitical triggers to the microeconomic reality for businesses, and finally to the strategic bedrock driving the US administration's hunger for the island.

The Domino Theory of Escalation

The tariff schedule follows a "Domino Theory" logic: start with Denmark, expand to the Nordics, and finally engulf the entire Eurozone. This phased approach aims to fracture EU unity.

The Ultimatum

Jan 2026. A 16-word post on Truth Social ignites a trans-Atlantic crisis. Explore the timeline to see how the threat evolves from rhetoric to policy.

Maximum pressure: Trade war imminent.

Target Nations

As escalation increases, tariffs spread across Europe. Click on countries to explore their exposure.

TARGET MAP. IMPACT INDEX (0-100) INTENSIFIES AS PHASES PROGRESS.

Denmark

DKThe Sovereign

High (Pharma, Food)

The Keystone. Holding the sovereignty of Greenland, Denmark faces the most direct pressure.

THREAT

80

Impact Index

ACTIVE

95

Impact Index

ESCALATION

100

Impact Index

The Wallet

Tariffs are not just paid by nations; they are paid by people. Simulate the impact on purchasing power as duties rise to 25%.

Select Import Item

Pass-Through Strategy

Consumer Pays

Strategic Insight

High Pass-Through: Prioritizing margin protection over volume.

High Sensitivity

High-end athleisure wear. High elasticity - consumers will switch brands if prices rise.

Find the Optimal Pass-Through Rate

Hover the curve to preview outcomes. Click to pin a selection. The tariff rate follows the selected phase.

The U-Shaped Loss Curve

TARIFF 25%Your Selection

Potential Savings

$0.0M

by adjusting to 18% pass-through

Optimal Strategy

Minimum Total Loss

$0.7M

The Bedrock

Why risk a trade war for ice? The answer lies beneath it. Explore the geology that drives the geopolitics.

The transition to a green economy (EVs, Wind Turbines) requires massive amounts of Rare Earth Elements (REEs). This is the "Green Paradox" - to go clean, we need to mine.

Greenland holds one of the world's largest undeveloped REE deposits at Kvanefjeld. However, the ore is inextricably mixed with uranium. Local legislation currently bans mining it, creating a bottleneck for Western supply chains desperate to decouple from Chinese processing. The US purchase offer is a brute-force attempt to unlock this supply.

Strategic Assets

RGS PSICSThe Boomerang

Brussels has learned from previous trade wars. The EU retaliation strategy is defined by Asymmetric Targeting. Instead of broad tariffs, they execute precision strikes on goods produced in the political home districts of key US decision-makers. The goal is not economic damage, but political pain.

RETALIATION IMPACT. POLITICAL SWING STATES TARGETED BY EU COUNTER-TARIFFS.

EU Counter-Measures

Retaliation Targets

Tactical Analysis

Premium spirits targeting. Aimed at Senate Minority Leader's home state.

Analysis and Simulation

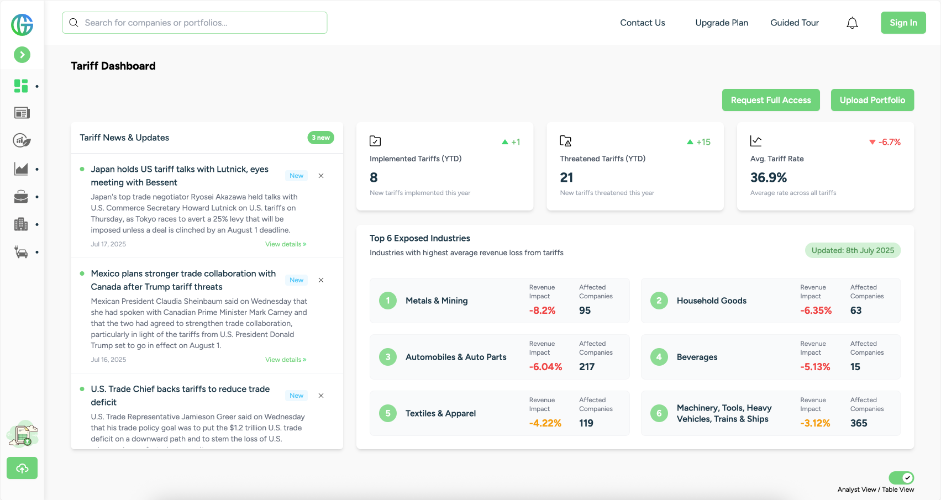

Our Tariff Tracker balances simplicity and depth. High level fields summarize the action, while expanders reveal product groups, country exemptions, and revision history. Scenario toggles can preview what-if changes before opening full simulations in the Tariff Tool.

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

The Greenland Tariff scenario is an analytical narrative that explores the economic consequences of escalating tariffs related to Greenland and Arctic trade routes. It demonstrates how trade policy shocks can ripple through global markets, companies, and consumers.

The analysis is designed to illustrate how tariff announcements translate into real economic outcomes. It combines data, visualization, and simulation to show how tariffs affect prices, demand, revenues, and market dynamics.

The scenario examines multiple layers of impact, including affected countries, consumer price changes, corporate revenue exposure, and pass-through effects. It highlights both direct and indirect consequences of tariff escalation.

The analysis uses structured tariff data, product-level exposure, and price elasticity of demand to simulate different outcomes. This allows users to explore how tariff costs may be absorbed by companies, passed on to consumers, or trigger shifts in demand.

The Greenland Tariff scenario showcases the capabilities of RGS Tariff Impact Analytics by applying its methodology in a real-world, forward-looking example. It serves as a practical demonstration of how tariff monitoring, analysis, and simulation work together.

The Greenland Tariff scenario is relevant for investors, policymakers, researchers, and corporate strategy teams seeking to understand how trade policy developments can influence markets, supply chains, and financial outcomes.