Fixed Income Climate Analytics

Assess the impact of climate change on securitized products, specifically Auto Loan Asset-Backed Securities (ABS), using our cutting-edge data and analytics solutions.

Comprehensive Database

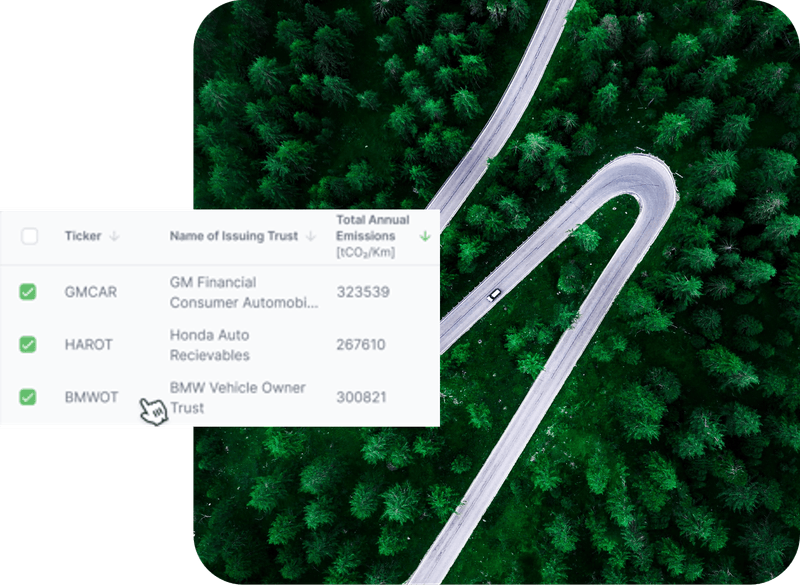

Our unique offering provides a comprehensive database of all car manufacturers, complete with associated emissions data. Simply upload your transaction data to our user-friendly platform to access our advanced analytics.

Both prime and subprime auto loans

Catering to US and EU markets

Granular Results

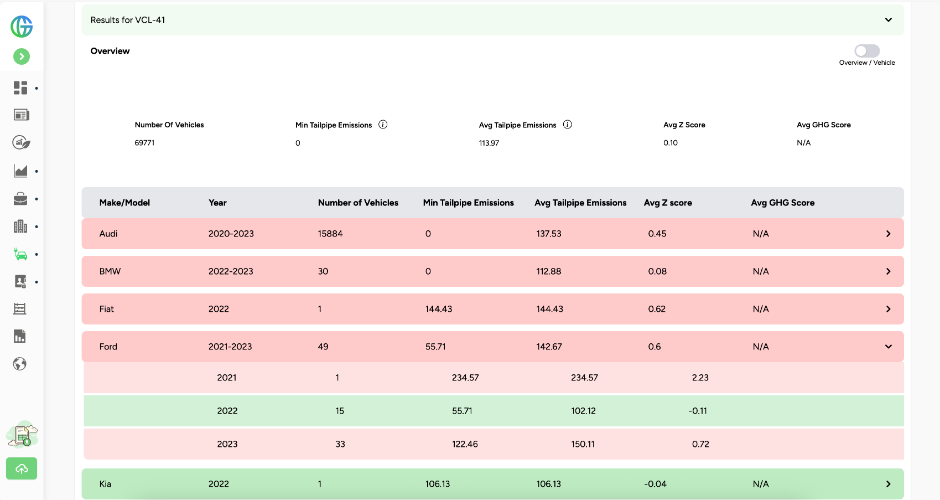

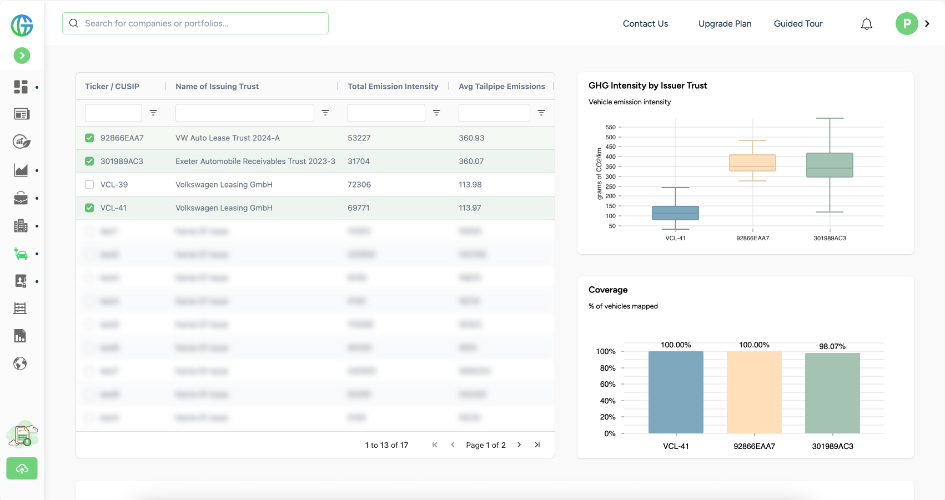

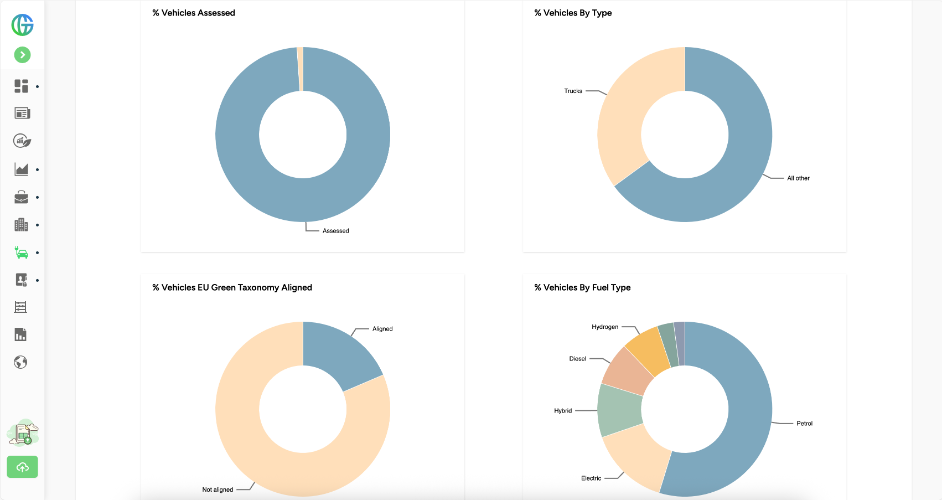

Gain detailed insights with our emission intensity metrics by manufacturer pool, fuel type, and country. Utilize our in-depth models and strategic forecasting tools for comprehensive analysis.

Intensity metrics and benchmarks

Alignment to regulatory green standards and sustainability objectives

Frequent Datadrop

Easy access to hundreds of securitizations and millions of auto loans mapped to emissions data, as well as real-time loan updates.

Climate data on 1M+ auto loans

Live datafeed

main use cases

Climate impacts reporting

Regulatory compliance

Portfolio management strategy

US, EU

two main markets

Cutting-edge Data & Analytics solution for Auto Loan Asset-Backed Securities (ABS)

300+

auto abs

Hundreds of securitizations and millions of auto loans mapped to emissions data

UNIQUE DATASET

Total annual CO2 emissions; Comparison with EU benchmark; Vehicle information (type, fuel type, % of vehicles EU Green taxonomy aligned); GHG emissions by issuer;

...and many more

Developed in partnership with academic experts

"As the debates surrounding ESG disclosures gain momentum at the asset class level, it becomes increasingly apparent that market participants need a clear and standardized perspective on Auto Loan ABS transactions from a climate change viewpoint.

The reduction in CO2 emissions intensity, varying patterns among manufacturers and countries, and mapping challenges collectively emphasize the need for robust data and advanced analytics in the Auto Loan ABS market. Our offering is a practical step forward, offering a resource for market participants to align with current regulatory expectations and to prepare for a future where environmental considerations are integral to financial evaluation and strategy."

Cristiano Zazzara

Senior Advisor,

RG Sciences

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

Fixed Income Climate Analytics assesses the climate impact and risk exposure of fixed income instruments, with a focus on securitized products such as Auto Loan Asset-Backed Securities (ABS). It links underlying assets to emissions and climate metrics to support informed investment decisions.

Climate risks can materially affect the performance of fixed income instruments through regulatory changes, transition risks, and asset-level exposure. For ABS, understanding the emissions profile of underlying assets, such as vehicles, provides deeper insight into long-term risk and alignment.

The solution combines detailed loan-level data, vehicle characteristics, manufacturer information, and emissions data. This enables granular analysis across both prime and subprime auto loans in US and EU markets.

Results can be analyzed by manufacturer, fuel type, vehicle category, country, and securitization structure. This level of granularity supports benchmarking, portfolio comparisons, and regulatory-aligned reporting.

Fixed Income Climate Analytics helps align fixed income portfolios with evolving climate disclosure requirements and sustainability objectives by providing transparent, asset-level emissions insights tailored to regulatory and ESG frameworks.

The solution is used by asset managers, fixed income investors, risk teams, and sustainability professionals to support climate impact reporting, portfolio management, and climate-related risk assessment.