AI Thematic Investing Solutions

Build thematic indexes with our thematic investing tool. Leverage our unique impact based revenue mapping (PSICS), NLP and GenAI to determine whether a company is a constituent of a specific theme.

Controversies and Screens

Our collective intelligence process methodically identifies, measures, and addresses controversies to enhance your research and robust investment strategy. Champion ESG principles while generating alpha and exceeding sustainable investing goals.

Manage investment risks

Amplify your impact

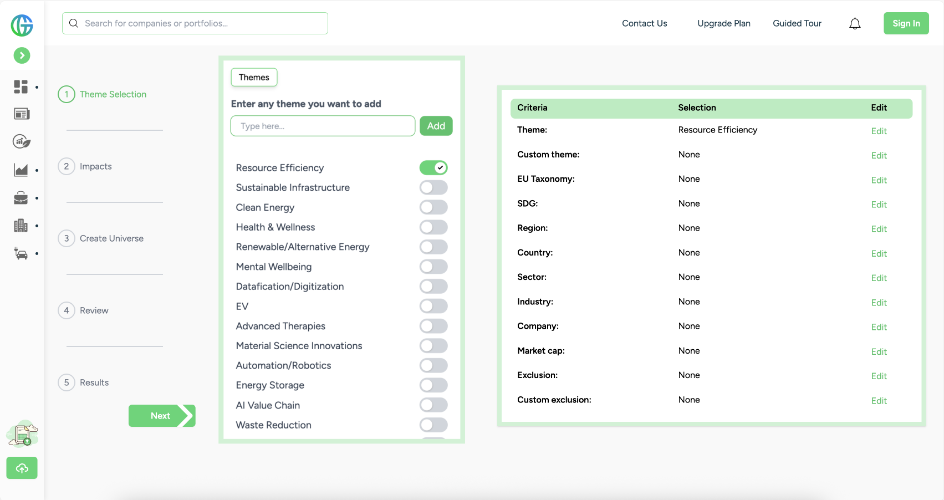

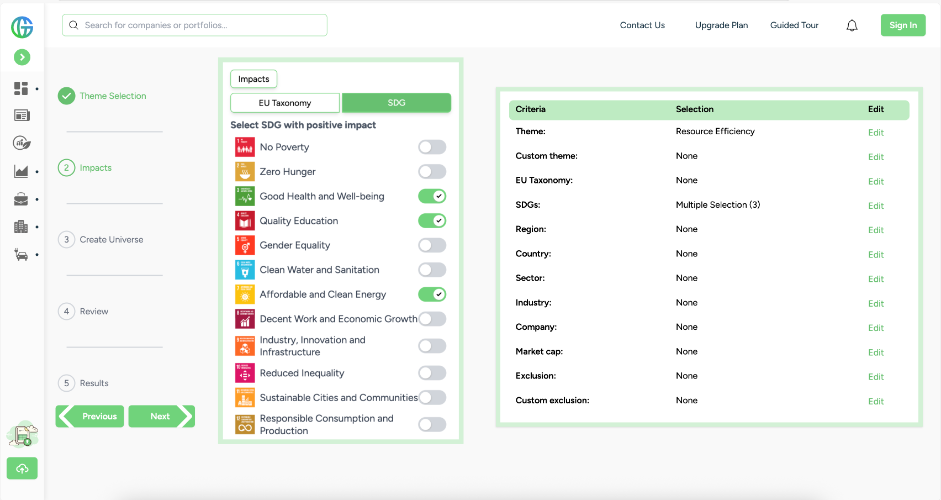

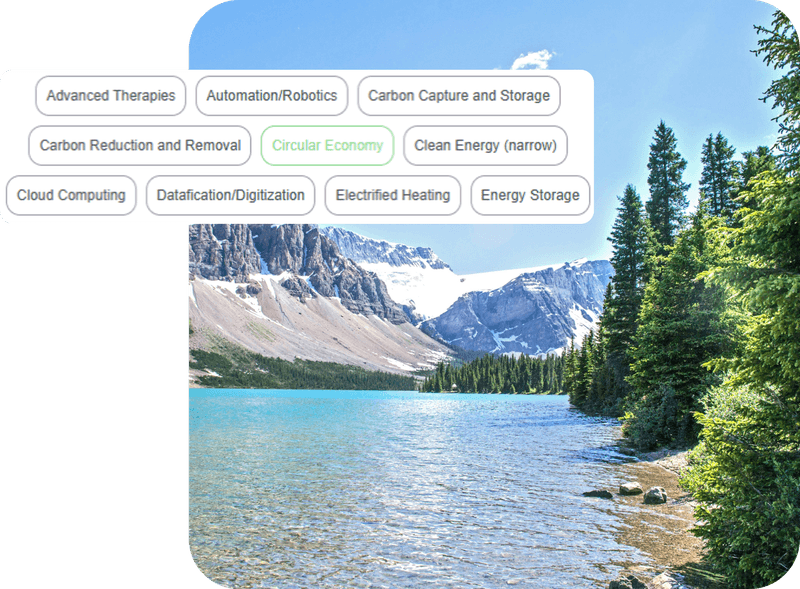

Easily accessible themes

Access a pre-populated list of the most common impact investing themes across environmental and social dimensions, such as Climate Action. To facilitate your opportunity set, we also integrated regulatory frameworks and alignment to the UN SDGs.

30+ impact investing themes

Developed by impact specialists

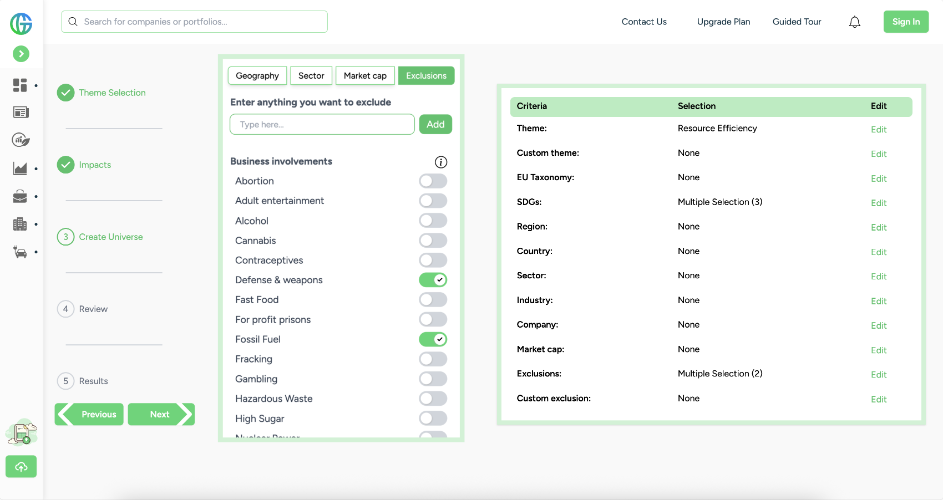

Hyper customization

Our tool offers the ability to fully customize every parameter of your portfolio creation. Develop your own themes that offer diversified exposures and are completely aligned with your values and preferences.

AI-powered theme creation

Maximize efficiency with universe construction

main use cases

Portfolio construction

Thematic investing

Equity research

Regulatory compliance

30+

investment themes

From climate transition and health & wellbeing to CSRD and UN SDGs, our tool can help you with thematic portfolio creation and regulatory compliance

10,000+

Global Public companies

Investment themes mapped to the business activities of global public firms

screens supported by rgs’ unique impact assessments

Environmental Impact screen, Employment Impact screen, Carbon Emissions screen, Product Recalls screen,

...and many more

2015 - present

Historical data coverage with quarterly / monthly updates

"Our team’s diverse and distinctive nature favors clients.

What do I mean by that? Well, our different ways of thinking and processing is a testament to our development of a unique and different method of grouping stocks, which is a granular product and services industry categorization system (PSICS). This novel tool not only provides distinction but also new ways and opportunities of connecting companies and finding relationships."

Jean Thomas

Chief Commercial Officer,

RG Sciences

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

AI Thematic Investing Solutions help investors build and analyze thematic portfolios based on specific sustainability, environmental, or social themes. They combine revenue-based data, impact assessments, and AI-driven analysis to identify companies aligned with each theme.

AI is used to process large volumes of revenue, product, and textual data to determine whether a company meaningfully contributes to a given theme. This enables more consistent theme classification, faster portfolio construction, and improved coverage across global markets.

The platform provides access to pre-defined themes such as climate action, health and wellbeing, and social inclusion, as well as fully customizable themes. Themes are designed by impact specialists and aligned with regulatory frameworks and the UN SDGs.

Controversies and exclusion screens are integrated into the thematic investing process to help manage investment risk. These screens assess factors such as environmental incidents, labor practices, and emissions exposure, supporting more responsible portfolio construction.

Yes, users can fully customize themes by adjusting revenue thresholds, impact criteria, and exclusion rules. AI-powered tools support the creation of tailored themes that reflect specific investment objectives and values.

AI Thematic Investing Solutions are used by asset managers, research teams, and sustainability professionals for portfolio construction, thematic investment strategies, equity research, and regulatory compliance.