Tariff Impact Analytics

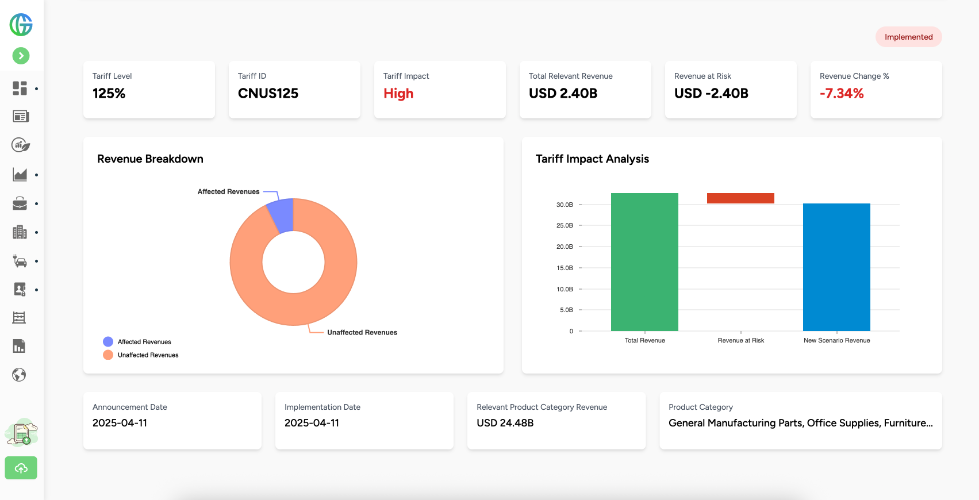

Tariff impact analytics quantifies how trade policy changes affect company revenues, costs, and market share. RGS combines live tariff data with product-level price elasticity of demand to model whether tariff costs are absorbed by companies, passed on to consumers, or result in revenue loss. Our unique Tariff Impact Analytics provide financial markets with a real-time insights into trade policy & regulatory risks on companies and investment portfolios. Powered by our Products & Services Revenue data feed and data on price elasticity of demand (PED) for 350+ Product Groups, our analytics equip users with predictive insights into how tariff costs may be absorbed by companies and their peers, passed on to consumers, or lead to shifts in revenue and market share.

Automated Quantitative Analytics

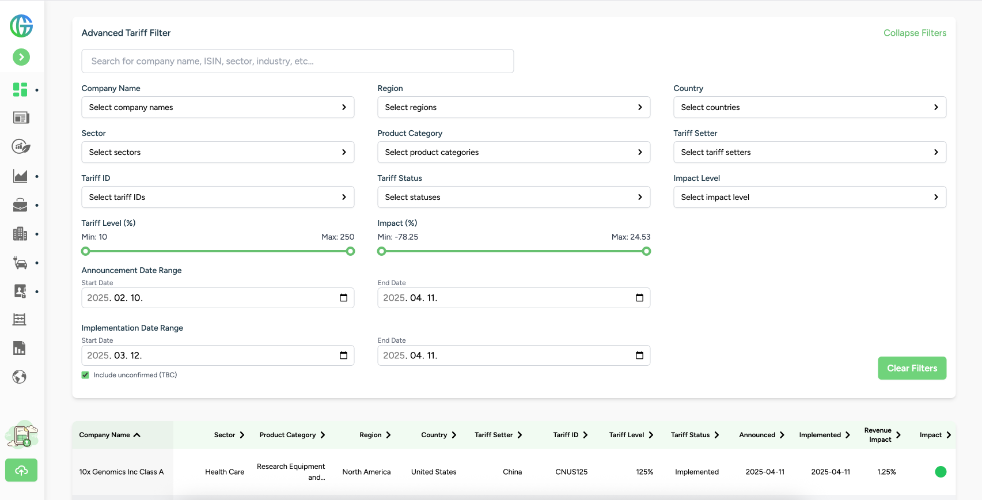

Move beyond the ‘which companies are impacted by tariffs’ to the ‘how much are they impacted’, using our advanced economic model. Users can filter data by industry, product category, trade route, or specific company. Each entity is evaluated based on its exposure to tariffs and regulatory measures, the level of impacted revenues and the price elasticity of demand of the products they sell. This enables quick identification of total revenue impacts.

Data for 10,000+ global public companies

Dynamic library of 350+ Price Elasticity of Demand values

Live Datafeed

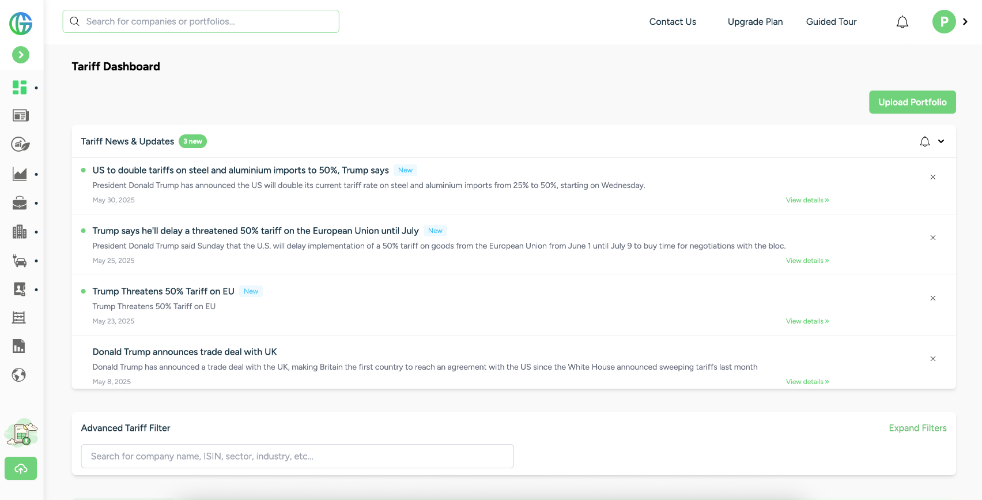

Daily feed of machine readable news is used to extract tariff types (threatened, implemented), levels, affected products and geographies. We map this information directly to Products and Business activities affected to identify relevant companies.

Covering all geographies and product groups

Tracking both threatened and implemented tariffs

Multiple use cases

Tariff Impact Analytics transforms complex, fragmented information into structured, actionable insights, empowering users to make informed decisions and proactively manage risks for companies, and company portfolios.

Tariffs affect every financial market segment

Trade policies and regulations are in constant flux

main use cases

Manage Credit Risk

Monitor Companies

Portfolio Allocation

Company Valuation

10,000+

Global Public companies

Granular geographic and impacted revenue data for public companies across sectors and geographies

News to Tariff Analytics

Live feed of news covering all geographies

Quant assessment

Identify the amount by which companies might be affected by certain tariffs

Price Elasticity of Demand for 350+ Product groups

Proprietary database describing the relationship between price increases and consumption for every product group within the economy

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

Tariff Impact Analytics quantifies how changes in trade policy and tariffs affect company revenues, costs, and market share. It combines tariff data with product-level revenue exposure and price elasticity of demand to assess the financial impact of tariffs.

Traditional tariff analysis often identifies which companies are exposed to tariffs. Tariff Impact Analytics goes further by estimating how much of the tariff cost is absorbed by companies, passed on to consumers, or results in changes to revenue and market share.

Price elasticity of demand measures how sensitive consumers are to price changes. By incorporating elasticity at the product-group level, Tariff Impact Analytics can model whether tariff-driven price increases lead to reduced demand or revenue loss.

The solution combines live trade policy and tariff data with RGS' Products and Services Revenue Datafeed and a proprietary library of price elasticity of demand values covering over 350 product groups.

Tariff Impact Analytics is used by asset managers, risk teams, and corporate strategy professionals to monitor trade policy risk, assess company exposure, and support portfolio allocation and valuation decisions.

Tariff data is updated continuously through a live datafeed that tracks threatened, implemented, and revised tariffs across geographies and product groups, enabling near real-time impact assessment.