Fixed Income Investors

We empower investors to assess the impact of climate change on securitized products, specifically Auto Loan Asset-Backed Securities (ABS). Stay tuned for additional products coming in the next few months.

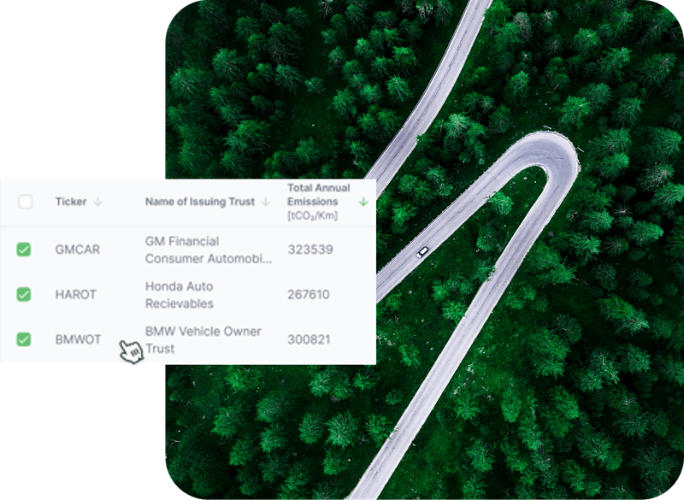

Fixed Income Climate Analytics

Access a comprehensive database of all car manufacturers, complete with associated emissions data.

click here to visit Fixed Income Climate Analytics pageLearn More

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

RGS supports fixed income investors by providing climate impact and risk analytics for securitized products, with a particular focus on Auto Loan Asset-Backed Securities (ABS). The platform enables investors to assess climate exposure at the underlying asset level.

Climate-related risks can affect fixed income performance through regulatory changes, transition risks, and shifts in asset values. Understanding these risks helps investors better manage long-term portfolio stability and compliance requirements.

RGS currently focuses on Auto Loan Asset-Backed Securities, with additional fixed income products planned. The analysis links underlying loan and vehicle data to emissions and climate metrics.

Climate data can be analyzed by manufacturer, vehicle type, fuel type, country, and securitization structure. This granularity supports detailed portfolio analysis and benchmarking.

Fixed income investors use climate analytics to support portfolio monitoring, climate impact reporting, regulatory compliance, and risk assessment related to transition and emissions exposure.

RGS solutions are used by fixed income portfolio managers, risk teams, ESG specialists, and analysts involved in climate-related assessment and reporting.