Impact Analytics

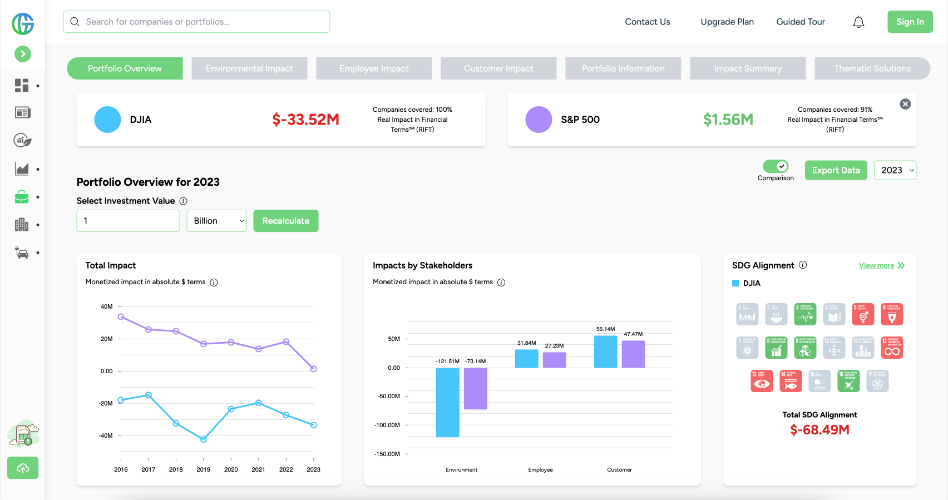

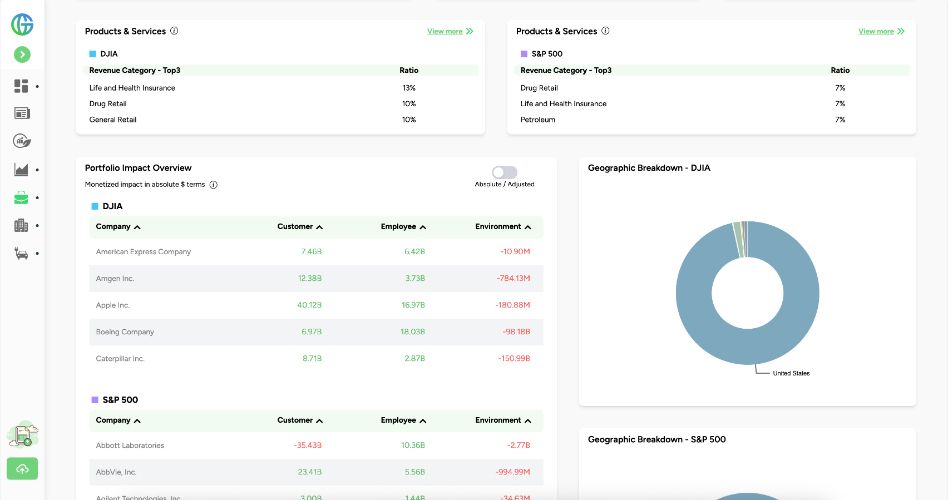

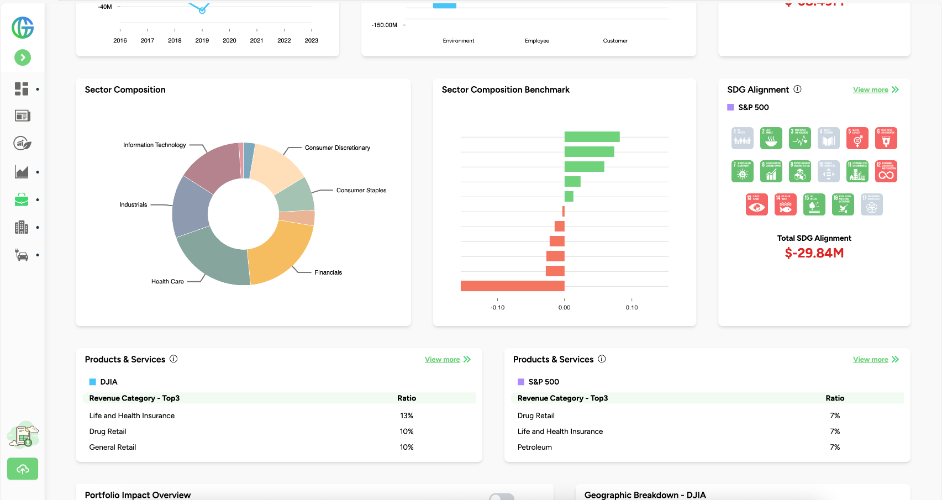

Our comprehensive impact assessment for publicly listed companies is aligned with impact accounting principles. By evaluating impact across three key stakeholders - Environment, Employees, and Customers - we offer investors an enhanced view of both long- and short-term risks and opportunities. By quantifying company impacts in monetary terms, we make this information accessible, actionable, and comparable to financial performance.

Science Based & Customizable

We don’t decide what is material – science does. Say goodbye to opaque ESG scores. Our patented engine leverages company-level raw data and the latest academic research to quantify impact through a process that is fully transparent and customizable to client needs.

Library of over 20 social costs

Data for 10,000+ global public companies

Risk, Return & Measurable Impact

Risk–return–impact influences every decision we make regarding consumption, employment, business and investment. Our impact data enables the Impact Revolution.

Identify risks and opportunities

Benchmark company performance

Report Impact

Report on impact with greater transparency and granularity by accessing the underlying data of every single metric. One-click or fully customizable reports to meet your preference and purpose.

Communicate portfolio impacts to clients

Show alignment to regulatory frameworks and UN SDGs

main use cases

Analyze portfolios

Monitor target companies

Report on impact

Produce research insights

Integrate impact in accounting frameworks

20+

research-based social costs

Quantified externalities with a focus on the impact of products & services

10,000+

Global Public companies

Monetized Impact Data on public firms across all sectors

2015 - PRESENT

Historical data coverage with annual / quarterly updates

IMPACT REVOLUTION

Inspired by the movement of Sir Ronald Cohen to create impact transparency

A 35-minute free interactive lesson led by Sir Ronald Cohen and RGS co-founder Professor George Serafeim that shows how impact accounting can help measure the positive and negative impacts organizations have on society and the environment.

click here to visit Watch the video pageWatch the video

WANT TO LEARN MORE?

Get early access to our latest features, industry insights, and updates.

Frequently Asked Questions

In this section, you will find answers to the most frequently asked questions related to this topic. The FAQ is designed to provide quick clarity on key concepts, features, and use cases, helping you better understand how our solutions work and how they can support your organization. We regularly update this section to reflect the most relevant questions and insights as our products and services evolve.

ESG Impact Analytics is a methodology for measuring how companies impact the environment, society, and the economy based on real-world outcomes. It translates environmental and social effects into monetary values, enabling impact to be analyzed alongside traditional financial metrics.

Traditional ESG scores focus on company policies, disclosures, and relative performance. ESG Impact Analytics measures actual impacts and externalities, providing a more objective and comparable view of how corporate activities affect stakeholders and the real economy.

ESG Impact Analytics covers environmental, social, and economic impacts, including emissions, resource use, employment effects, and broader societal outcomes. These impacts are quantified using science-based models and expressed in financial terms.

Monetizing impact allows investors to directly compare ESG outcomes with financial performance. This helps identify hidden risks, long-term value drivers, and trade-offs that may not be visible through qualitative ESG indicators alone.

ESG Impact Analytics is used by asset managers, institutional investors, corporates, and researchers seeking to integrate measurable impact into investment analysis, portfolio management, and regulatory or sustainability reporting.

By combining impact data with financial analysis, ESG Impact Analytics enables better-informed decisions on portfolio construction, company selection, risk assessment, and impact-driven investment strategies.